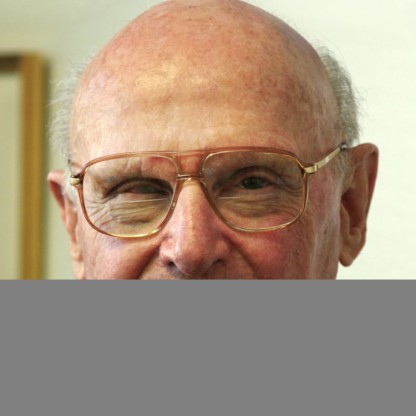

Markowitz now divides his time between teaching (he is an adjunct professor at the Rady School of Management at the University of California at San Diego, UCSD); video casting lectures; and consulting (out of his Harry Markowitz Company offices). He currently serves on the Advisory Board of BPV Capital Management (formerly SkyView Investment Advisors), an alternative investment advisory firm and fund of hedge funds. Markowitz also serves on the Investment Committee of LWI Financial Inc. ("Loring Ward"), a San Jose, California-based investment advisor; on the advisory panel of Robert D. Arnott's Newport Beach, California based investment management firm, Research Affiliates; on the Advisory Board of Mark Hebner's Irvine, California and internet based investment advisory firm, Index Fund Advisors; and as an advisor to the Investment Committee of 1st Global, a Dallas, Texas-based wealth management and investment advisory firm. Markowitz advises and serves on the board of ProbabilityManagement.org, a 501(c)(3) non-profit founded by Dr. Sam L. Savage to reshape the communication and calculation of uncertainty.