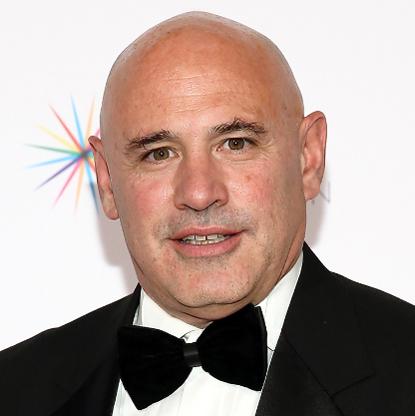

In 2013, Charles Rosier, a partner of BTG Pactual, was convicted in the largest insider trading case in the history of France. While at UBS, at the end of March and early April 2008, he and his cousin Joseph Raad used inside information to purchase shares and options in Geodis just before the announcement of a takeover bid. Of significance, Rosier worked at UBS when he participated in the insider trades when André Esteves, now CEO, partner and Director of BTG Pactual, still worked for UBS as head of fixed income in charge of $1.7 trillion USD. Esteves had also committed inside trades while at UBS only a few months earlier in November 2007. Also of significance, Huw Jenkins, partner and Director and chairman of BTG Pactual and formerly CEO of UBS Investment Bank, was a consultant to UBS at the same time.